Reading: The New Deal

The New Deal

Within days of his inauguration, President Roosevelt presented the Emergency Banking Act to Congress, which quickly approved the legislation. Here, Roosevelt signs the bill, making it law.

When America hit rock bottom, Americans expected bold leadership.

Herbert Hoover was perceived as doing nothing to help when the nation was in its darkest hour. When the votes were tallied in 1932, Americans made a strong statement for change, and sent Franklin D. Roosevelt to the White House. Ironically, Roosevelt made few concrete proposals during the campaign, merely promising "a new deal for the American people." The plan that ultimately emerged during his Presidency was among the most ambitious in the history of the United States.

With the unemployment rate at an incredible 25%, FDR realized that jobs were needed to get people back on their feet. A few of the 8,500,000 participants in the New Deal's Works Progress Administration are shown here hard at work in Tuskeegee, Alabama.

FRANKLIN ROOSEVELTwas born in 1882 to a wealthy New York industrialist. The fifth cousin of THEODORE ROOSEVELT, FDR became involved in politics at a young age. A strong supporter of WOODROW WILSON and the LEAGUE OF NATIONS, Roosevelt became the unsuccessful Democratic candidate for Vice-President in 1920. The following year he contracted polio, and learned that he could never walk without crutches again.

Roosevelt campaigned hard for fellow New Yorker AL SMITH's 1924 and 1928 Presidential bids and then received Smith's support to run for governor of New York. In his two terms as governor of New York, Roosevelt earned a reputation as a progressive reformer. He then threw his hat into the ring of Presidential politics.

Radio's golden era coincided with Roosevelt's presidency. Radio shows entertained, advertised, and made an escape for American audiences. Roosevelt wisely used his weekly "Fireside Chats" to keep in touch with the populace.

Roosevelt had no grand strategy to fix the Depression. He was a bold experimenter. FDR liked to examine an idea and evaluate it on its philosophical merits. The details could be negotiated later. If it worked, fine. If not, he was more than willing to start over with a new plan. He surrounded himself with competent advisors, and delegated authority with discretion and confidence. As a master of the radio, his confidence was contagious among the American populace.

Before his first term expired, Roosevelt signed legislation aimed at fixing banks and the stock market. He approved plans to aid the unemployed and the nations farmers. He began housing initiatives and ventures into public-owned electric power. New Deal programs aided industrialists and laborers alike. His friends and enemies grew with every act he signed into law.

The NEW DEAL sparked a revolution in American public thought regarding the relationship between the people and the federal government.

A Bank Holiday

Before the Banking Reform Act of 1933, keeping your money in a bank was not a sure way to save. If the bank made unwise investments, the bank could fail and depositors' money would be lost. Here, depositors line up outside a Detroit bank hoping to get their savings back.

In days past, depositing money in a savings account carried a degree of RISK. If a bank made bad investments and was forced to close, individuals who did not withdraw their money fast enough found themselves out of luck. Sometimes a simple rumor could force a bank to close. When DEPOSITORS feared a bank was unsound and began removing their funds, the news would often spread to other customers. This often caused a panic, leading people to leave their homes and workplaces to get their money before it was too late.

These runs on banks were widespread during the early days of the Great Depression. In 1929 alone, 659 banks closed their doors. By 1932, an additional 5102 banks went out of business. Families lost their life savings overnight. Thirty-eight states had adopted restrictions on withdrawals in an effort to forestall the panic. Bank failures increased in 1933, and Franklin Roosevelt deemed remedying these failing financial institutions his first priority after being inaugurated.

With quick and effective legislation, Franklin Delano Roosevelt, 32nd President of the United States, was able to halt the bank crisis.

Roosevelt, unlike Hoover, was quick to act. Two days after taking the oath of office, Roosevelt declared a "BANK HOLIDAY." From March 6 to March 10, banking transactions were suspended across the nation except for making change. During this period, Roosevelt presented the new Congress with theEMERGENCY BANKING ACT. The law empowered the President through the TREASURY DEPARTMENT to reopen banks that were solvent and assist those that were not. The House allowed only forty minutes of debate before passing the law unanimously, and the Senate soon followed with overwhelming support.

Banks were divided into four categories. Surprisingly, slightly over half the nation's banks were deemed first category and fit to reopen. The second category of banks was permitted to allow a percentage of its deposits to be withdrawn. The third category consisted of banks that were on the brink of collapse. When the holiday was ended, these banks were only permitted to accept deposits. Five percent of banks were in the final category — unfit to continue business.

On the Sunday evening before the banks reopened, Roosevelt addressed the nation through one of his signature "FIRESIDE CHATS." With honest words in soothing tones, the President assured sixty million radio listeners that the crisis was over and the nation's banks were secure. On the first day back in business, deposits exceeded withdrawals. By the beginning of April, Americans confidently returned a billion dollars to the banking system. The bank crisis was over.

Ms. Lydia Lobsiger became the first American citizen to be paid by the Federal Deposit Insurance Corporation for deposits in an insured bank that failed.

But the legislation was not. On June 16, 1933, Roosevelt signed the GLASS-STEAGALL BANKING REFORM ACT. This law created the FEDERAL DEPOSIT INSURANCE CORPORATION. Under this new system, depositors in member banks were given the security of knowing that if their bank were to collapse, the federal government would refund their losses. Deposits up to $2500, a figure that would rise through the years, were henceforth 100% safe. The act also restricted banks from recklessly speculating depositors' money in the stock market. In 1934, only 61 banks failed .

Letters poured in to the White House from grateful Americans. Workers and farmers were thrilled that their savings were indeed now safe. Bankers breathed a sigh of relief knowing that Roosevelt did not intend to nationalize the banking system as many European countries had already done. Although radical in speed and scope, Roosevelt's banking plan strengthened the current system, without fundamentally altering it. One of his advisors quipped, "Capitalism was saved in eight days."

Putting People Back to Work

Over 9,000,000 Americans were involved in a multitude of Works Progress Administration projects, from building roads to beautifying government buildings. The above WPA mural depicts the arrival of the first train west of Chicago and can be found in an Oak Park, Illinois, post office.

Out of work Americans needed jobs. To the unemployed, many of whom had no money left in the banks, a decent job that put food on the dinner table was a matter of survival.

Unlike Herbert Hoover, who refused to offer direct assistance to individuals, Franklin Roosevelt knew that the nation's unemployed could last only so long. Like his banking legislation, aid would be immediate. Roosevelt adopted a strategy known as "priming the pump." To start a dry pump, a farmer often has to pour a little into the pump to generate a heavy flow. Likewise, Roosevelt believed the national government could jump start a dry economy by pouring in a little federal money.

The first major help to large numbers of jobless Americans was the FEDERAL EMERGENCY RELIEF ACT. This law gave $3 billion to state and local governments for direct relief payments. Under the direction ofHARRY HOPKINS, FERA assisted millions of Americans in need. While Hopkins and Roosevelt believed this was necessary, they were reticent to continue this type of aid. Direct payments might be "narcotic," stifling the initiative of Americans seeking paying jobs. Although FERA lasted two years, efforts were soon shifted to "work-relief" programs. These agencies would pay individuals to perform jobs, rather than provide handouts.

Of the many programs instituted by the New Deal, the Civilian Conservation Corps was one of the most popular and successful. Here, FDR meets with some of the participants in the CCC.

The first such initiative began in March 1933. Called the CIVILIAN CONSERVATION CORPS, this program was aimed at over two million unemployed unmarried men between the ages of 17 and 25. CCC participants left their homes and lived in camps in the countryside. Subject to military-style discipline, the men built reservoirs and bridges, and cut fire lanes through forests. They planted trees, dug ponds, and cleared lands for camping. They earned $30 dollars per month, most of which was sent directly to their families. The CCC was extremely popular. Listless youths were removed from the streets and given paying jobs and provided with room and shelter.

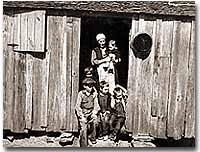

Living conditions during the Depression were often abhorrent. Mrs. Handley and some of her children seek shelter in a shack in Walker County, Alabama.

There were plenty of other opportunities for the unemployed in the New Deal. In the fall of 1933, Roosevelt authorized theCIVIL WORKS ADMINISTRATION. Also headed by Hopkins, this program employed 2.5 million in a month's time, and eventually grew to a multitudinous 4 million at its peak.

Earning $15 per week, CWA workers tutored the illiterate, built parks, repaired schools, and constructed athletic fields and swimming pools. Some were even paid to rake leaves. Hopkins put about three thousand writers and artists on the payroll as well. There were plenty of jobs to be done, and while many scoffed at the make-work nature of the tasks assigned, it provided vital relief during trying times.

The largest relief program of all was the WORKS PROGRESS ADMINISTRATION. When the CWA expired, Roosevelt appointed Hopkins to head the WPA, which employed nearly 9 million Americans before its expiration. Americans of all skill levels were given jobs to match their talents. Most of the resources were spent on public works programs such as roads and bridges, but WPA projects spread to artistic projects too.

Before the advent of Social Security, many unemployed Americans were forced to seek food from shelters and soup kitchens. This Chicago soup kitchen was sponsored by the notorious gangster Al Capone.

The FEDERAL THEATER PROJECT hired actors to perform plays across the land. Artists such as BEN SHAHN beautified cities by painting larger-than-life murals. Even such noteworthy authors as JOHN STEINBECKand RICHARD WRIGHT were hired to write regional histories. WPA workers took traveling libraries to rural areas. Some were assigned the task of transcribing documents from colonial history; others were assigned to assist the blind.

Critics called the WPA "We Piddle Around" or "We Poke Along," labeling it the worst waste of taxpayer money in American history. But most every county in America received some service by the newly employed, and although the average monthly salary was barely above subsistence level, millions of Americans earned desperately needed cash, skills, and self-respect.

The Farming Problem

Years of plowing and planting left soil depleted and weak. As a result, clouds of dust fell like brown snow over the Great Plains.

Farmers faced tough times. While most Americans enjoyed relative prosperity for most of the 1920s, the Great Depression for the American farmer really began after World War I. Much of the Roaring '20s was a continual cycle of debt for the American farmer, stemming from falling farm prices and the need to purchase expensive machinery. When the stock market crashed in 1929 sending prices in an even more downward cycle, many American farmers wondered if their hardscrabble lives would ever improve.

The first major New Deal initiative aimed to help farmers attempted to raise farm prices to a level equitable to the years 1909-14. Toward this end, theAGRICULTURAL ADJUSTMENT ADMINISTRATION was created. One method of driving up prices of a commodity is to create artificial scarcity. Simply put, if farmers produced less, the prices of their crops and livestock would increase.

The AAA identified seven BASIC FARM PRODUCTS: wheat, cotton, corn, tobacco, rice, hogs, and milk. Farmers who produced these goods would be paid by the AAA to reduce the amount of acres in cultivation or the amount of LIVESTOCKraised. In other words, farmers were paid to farm less!

Adolph Johnson, a farmer in Rutland, Oregon, poses in front of his tobacco crop. The Agricultural Adjustment Act provided much needed relief for farmers by paying them not to grow crops, thus helping to adjust prices.

The press and the public immediately cried foul. To meet the demands set by the AAA, farmers plowed under millions of acres of already planted crops. Six million young pigs were slaughtered to meet the subsidy guidelines. In a time when many were out of work and tens of thousands starved, this wasteful carnage was considered blasphemous and downright wrong.

But farm income did increase under the AAA. Cotton, wheat, and corn prices doubled in three years. Despite having misgivings about receiving government subsidies, farmers overwhelmingly approved of the program. Unfortunately, the bounty did not trickle down to the lowest economic levels. Tenant farmers and sharecroppers did not receive government aid; the subsidy went to the landlord. The owners often bought better machinery with the money, which further reduced the need for farm labor. In fact, the Great Depression and the AAA brought a virtual end to the practice of sharecropping in America.

The Supreme Court put an end to the AAA in 1936 by declaring it unconstitutional. At this time the Roosevelt administration decided to repackage the agricultural subsidies as incentives to save the environment. After years and years of plowing and planting, much of the soil of the Great Plains and become depleted and weak. Great winds blew clouds of dust that fell like brown snow to cover homes across the region as residents of the "Dust Bowl" moved west in search of better times.

The SOIL CONSERVATION AND DOMESTIC ALLOTMENT ACT paid farmers to plant clover and alfalfa instead of wheat and corn. These crops return nutrients to the soil. At the same time, the government achieved its goal of reducing crop acreage of the key commodities.

Issuing food stamps was a New Deal initiative designed to help farmers and consumers alike.

Another major problem faced by American farmers was mortgage foreclosure. Unable to make the monthly payments, many farmers were losing their property to their banks. Across the CORN BELT of the Midwest, the situation grew desperate. Farmers pooled resources to bail out needy friends. Minnesota and North Dakota passed laws restricting FARM FORECLOSURES. Vigilante groups formed to intimidate bill collectors. In Le Mars, Iowa, an angry mob beat a foreclosing judge to the brink of death in April 1933.

FDR intended to stop the madness. The FARM CREDIT ACT, passed in March 1933 refinanced many mortgages in danger of going unpaid. The FRAZIER-LEMKE FARM BANKRUPTCY ACT allowed any farmer to buy back a lost farm at a law price over six years at only one percent interest. Despite being declared unconstitutional, most of the provisions of Frazier-Lemke were retained in subsequent legislation.

In 1933 only about one out of every ten American farms was powered by electricity. The RURAL ELECTRIFICATION AUTHORITY addressed this pressing problem. The government embarked on a mission of getting electricity to the nation's farms. Faced with government competition, private utility companies sprang into action and by sending power lines to rural areas with a speed previously unknown. By 1950, nine out of every ten farms enjoyed the benefits of electric power.

Social Security

Social Security not only directly aided those who had retired and widows and orphans of insured workers, but it also encouraged states to provide more far-reaching social assistance programs.

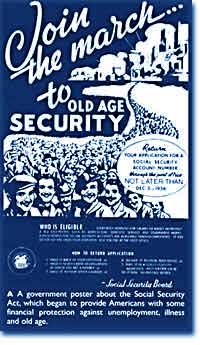

PENSIONS for the retired or the notion of Social Security was not always the domain of the federal government. Individuals were expected to save a little of each paycheck for the day they would at last retire. Those who were aggressive enough to negotiate a pension plan with an employer were few indeed. The majority of working Americans, however, lived check to check, with little or nothing extra to be saved for the future. Many became a drag on the rest of the family upon retirement. The SOCIAL SECURITY ACT OF 1935 aimed to improve this predicament.

Many nations in Europe had already experimented with pension plans. Britain and Germany had found exceptional success. The American plan was a bit different in its design. SOCIAL SECURITYwas described as a "contract between generations." The current generation of workers would pay into a fund while the retirees would take in a monthly stipend. Upon reaching the age of 65, individuals would start receiving payments based upon the amount contributed over the years.

Businesses that accepted fair trade codes under the National Recovery Administration were allowed to display the blue eagle symbol of the program.

Employees would have one percent of their incomes automatically deducted from their paychecks, a rate that was originally envisioned to reach 3%. Employers would also contribute for their employees. The plan was mandatory except for individuals in exempted professions. Roosevelt knew that this reform would be permanent. He guessed that once workers had paid into a system for decades, they would expect to receive their checks. Woe to the politician who tried to end the system once it was in place.

President Roosevelt signed the Social Security Act into law in 1935. Designed to pay retired workers age 65 or older a continuing income after retirement, this act helped Americans breathe easier about their futures.

A committee of staffers led by SECRETARY OF LABOR FRANCES PERKINS, the first female ever to hold a Cabinet position, penned the Social Security Act. In addition to providing old- age pensions, the legislation created a safety net for other Americans in distress. Unemployment insurance was part of the plan, to be funded by employers. The federal government also offered to match state funds for the blind and for job training for the physically disabled. Unmarried women with dependent children also received funds under the Social Security Act.

Roosevelt and his advisers knew that the Social Security Act was not perfect. Like other experiments, he hoped the law would set the groundwork for a system that could be refined over time. Social Security differed from European plans in that it made no effort to provide universal health insurance. The pensions that retirees received were extremely modest — below poverty level standards in most cases. Still, Roosevelt knew the plan was revolutionary. For the first time, the federal government accepted permanent responsibility for assisting people in need. It paved the way for future legislation that would redefine the relationship between the American people and their government.

FDR's Alphabet Soup

In addition to setting a minimum wage and the maximum hours a person could work in a week, the National Recovery Administration outlawed child labor.

The New Deal was clearly the most ambitious legislative program ever attempted by Congress and an American President.

Progressive politicians saw their wildest dreams come alive. The Great Depression created an environment where the federal government accepted responsibility for curing a wide array of society's ills previously left to individuals, states, and local governments. This amount of regulation and involvement requires a vast upgrading of the government bureaucracy. An armada of government bureaus and regulatory agencies was erected to service the programs of the New Deal. Collectively, observers called them the "ALPHABET AGENCIES."

While the CCC, CWA, and WPA were established to provide relief for the unemployed, the New Deal also provided a program intended to boost both industries and working Americans. The National Industrial Recovery Act contained legislation designed to spark business growth and to improve labor conditions. The National Recovery Administration attempted to create a managed economy by relieving businesses of antitrust laws to eliminate "wasteful competition." The NRA, like the AAA for farmers, attempted to create artificial scarcity with commodities. The hope was that higher prices would yield higher profits and higher wages leading to an economic recovery.

In 1933, Roosevelt asked Congress to create "a corporation clothed with the power of government but possessed of the flexibility and initiative of a private enterprise." The Tennessee Valley Authority was born, and economic recovery came to eastern Tennessee.

To avoid charges of SOCIALISM, the NRA allowed each industry to draw up a code setting production quotas, limiting hours of operation, or restricting construction of new factories. Once the President approved each code, pressure was put on each business to comply. APROPAGANDA campaign reminiscent of World War I ensued. Firms that participated in the NRA displayed blue eagles reminding consumers of a company's apparent patriotism.

To enlist the support of LABOR UNIONS, the NRA outlawed child labor, set maximum hours, and required a MINIMUM WAGE. The greatest victory for labor unions was the guarantee of the right to collective bargaining, which led to a dramatic upsurge in union membership. Unfortunately, the NRA did little to improve the economy. The increase in prices actually caused a slight slowdown in the recovery. Workers complained that participating industries found loopholes to violate minimum wage and child labor obligations. When the Supreme Court finally declared the NRA unconstitutional in 1936, many had taken to calling it the "National Run Around."

By displaying the Blue Eagle, businesses indicated that they had joined the National Recovery Administration. By 1933, over 2 million participants in the NRA were hanging Blue Eagle window signs, posters and flags.

The government blazed other new trails by creating the TENNESSEE VALLEY AUTHORITY in May 1933. The geography of the Tennessee River Valley had long been a problem for its residents. Centuries of resource exploitation contributed to soil erosion and massive, unpredictable floods that left parts of seven states impoverished and underutilized.

Funds were authorized to construct 20 new dams and to teach residents better soil management. The hydroelectric power generated by the TVA was sold to the public at low prices, prompting complaints from private power companies that the government was presenting unfair competition. Soon FLOOD CONTROL ceased to be a problem and FDR considered other regional projects.

There seemed to be no end to the alphabet soup. The SECURITIES AND EXCHANGE COMMISSION (SEC) was created to serve as a watchdog on the stock market. The FEDERAL HOUSING AUTHORITY (FHA) provided low interest loans for new home construction. The HOME OWNERS LOAN CORPORATION (HOLC) allowed homeowners to refinance mortgages to prevent foreclosure or to make home improvements. The UNITED STATES HOUSING AUTHORITY (USHA) initiated the idea of government-owned low-income housing projects. ThePUBLIC WORKS ADMINISTRATION (PWA) created thousands of jobs by authorizing the building of roads, bridges, and dams. The NATIONAL YOUTH ADMINISTRATION (NYA) provided college students with work-study jobs. TheNATIONAL LABOR RELATIONS BOARD (NLRB) was designed to protect the right of collective bargaining and to serve as a liaison between deadlock industrial and labor organizations.

Critics bemoaned the huge costs and rising national debt and spoon-feeding Americans. Regardless, many of the programs found in FDR's "alphabet soup" exist to this day.

Roosevelt's Critics

Father Charles Coughlin's fiery radio broadcasts reached an estimated 40,000,000 listeners and attempted to sway popular opinion away from Franklin D. Roosevelt and his New Deal policies.

FDR was a President, not a king. His goals were ambitious and extensive, and while he had many supporters, his enemies were legion. Liberals and radicals attacked from the left for not providing enough relief and for maintaining the fundamental aspects of capitalism. Conservatives claimed his policies were socialism in disguise, and that an interfering activist government was destroying a proud history of self-reliance.

Despite big numbers at the ballot booth, Roosevelt needed to temper his objectives with the spirit of compromise and hope that his plans were popular enough to weather criticism. Friends and enemies alike had to admit that FDR was a political genius.

One major threat to FDR came from FATHER CHARLES E. COUGHLIN, a radio priest from Detroit. Originally a supporter of the New Deal, Coughlin turned against Roosevelt when he refused to nationalize the banking system and provide for the free coinage of silver. As the decade progressed, Coughlin turned openly anti-Semitic, blaming the Great Depression on an international conspiracy of Jewish bankers. Coughlin formed the NATIONAL UNION FOR SOCIAL JUSTICE and reached a weekly audience of 40 million radio listeners.

Advocating a program to "share the wealth," U.S. Senator from Louisiana Huey "Kingfish" Long in August 1935 announced his intention to run for President against FDR, but an assassin's bullet ended his life less than a month later.

Another reformer who felt the New Deal had not gone far enough was FRANCIS TOWNSEND, a doctor from Long Beach, California. Townsend proposed the OLD AGE REVOLVING PENSION. This plan called for every American over the age of sixty to retire to open up jobs for the younger unemployed. The retirees would receive a monthly check for $200, a considerable income during the Depression. There was one catch. The recipients had to agree to spend the entire sum within a month. Townsend argued that this plan would ignite the economy, as well as provide for a proper pension for those who had worked so hard for so long.

The person considered the greatest threat to Roosevelt politically was HUEY "THE KINGFISH" LONG of Louisiana. Long was a rollicking country lawyer who became governor of Louisiana in 1928. As governor, Long used strong-arm tactics to intimidate the legislature into providing roads and bridges to the poorest parts of the state. He emerged onto the national scene with his election to the United States Senate in 1930. In 1934, he started a movement called "SHARE OUR WEALTH." With the motto "EVERY MAN A KING," Long proposed a 100% tax on personal fortunes exceeding a million dollars. The elderly would receive pensions. The poorest Americans were promised an estate worth no less than $5000, with a $2500 yearly minimum income guaranteed. Democrats worried that a Long bid for the Presidency might steal votes from FDR in 1936, but an assassin's bullet ended the Kingfish's life in 1935.

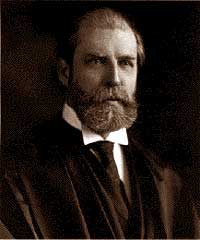

As Chief Justice of the Supreme Court during the New Deal, Charles Evans Hughes often voted to uphold controversial legislation. But there was little doubt when it came to FDR's "court-packing scheme" — Hughes was vehemently opposed.

Despite his reelection landslide, Roosevelt's mainstream opponents gained steam in the latter part of the decade. Frustrated by a conservative Supreme Court overturning New Deal initiatives, FDR hatched a "COURT PACKING" scheme. He proposed that when a federal judge reached the age of seventy and failed to retire, the President could add an additional justice to the bench. This thinly veiled scheme would immediately enable him to appoint six justices to the high court.

Conservative Democrats and Republicans charged FDR with abuse of power and failed to support the plan. During the 1938 Congressional elections, Roosevelt campaigned vigorously against anti-New deal Democrats. In nearly every case, the conservatives won. This COALITION OF SOUTHERN DEMOCRATS AND REPUBLICANSdominated the Congress until the 1960s and effectively ended the reform spirit of the New Deal.

An Evaluation of the New Deal

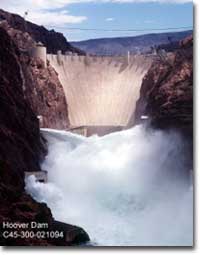

At the time of its construction during the Great Depression, the Hoover Dam was the largest in the world. To this day, it uses the power of the Colorado River to electrify the region.

How effective was the New Deal at addressing the problems of the Great Depression?

No evaluation of the New Deal is complete without an analysis of Roosevelt himself. As a leader, his skills were unparalleled. Desperate times called for desperate measures, and FDR responded with a bold program of experimentation that arguably saved the capitalist system and perhaps the American democracy. As sweeping as his objectives were, they still fundamentally preserved the free-market economy. There was no nationalization of industry, and the social safety net created by Social Security paled by European standards.

Observers noted that his plan went far enough to silence the "lunatic fringe," but not far enough to jeopardize capitalism or democracy. FDR's confidence was contagious as millions turned to him for guidance during their darkest hours. His mastery of the radio paved the way for the media-driven 20th-century Presidency. His critics charged that he abused his power and set the trend for an imperial Presidency that would ultimately endanger the office in future decades.

This Franklin D. Roosevelt campaign pin features a donkey, the symbol of the Democratic party.

The New Deal itself created millions of jobs and sponsored public works projects that reached most every county in the nation. Federal protection of bank deposits ended the dangerous trend of bank runs. Abuse of the stock market was more clearly defined and monitored to prevent collapses in the future. The Social Security system was modified and expanded to remain one of the most popular government programs for the remainder of the century. For the first time in peacetime history the federal government assumed responsibility for managing the economy. The legacy of social welfare programs for the destitute and underprivileged would ring through the remainder of the 1900s.

Laborers benefited from protections as witnessed by the emergence of a new powerful union, the CONGRESS OF INDUSTRIAL ORGANIZATIONS. African Americans and women received limited advances by the legislative programs, but FDR was not fully committed to either civil or women's rights. All over Europe, fascist governments were on the rise, but Roosevelt steered America along a safe path when economic spirits were at an all-time low.

However comprehensive the New Deal seemed, it failed to achieve its main goal: ending the Depression. In 1939, the unemployment rate was still 19 percent, and not until 1943 did it reach its pre-Depression levels. The massive spending brought by the American entry to the Second World War ultimately cured the nation's economic woes.

Conservatives bemoaned a bloated bureaucracy that was nearly a million workers strong, up from just over 600,000 in 1932. They complained that Roosevelt more than doubled the national debt in two short terms, a good deal of which had been lost through waste. Liberals pointed out that the gap between rich and poor was barely dented by the end of the decade. Regardless of its shortcomings, Franklin Roosevelt and the New Deal helped America muddle through the dark times strong enough to tackle the even greater task that lay ahead.