Reading: Short and Long Term Debt Financing

Applying for a Business Loan

•The

assets or other financial resources available to a business are called capital.

•Purchases

of plant assets used in the operation of a business are called capital

expenditures.

•Assets

pledged to a creditor to guarantee repayment of a loan are called collateral

Making

a Monthly Payment on a Long-Term Note Payable

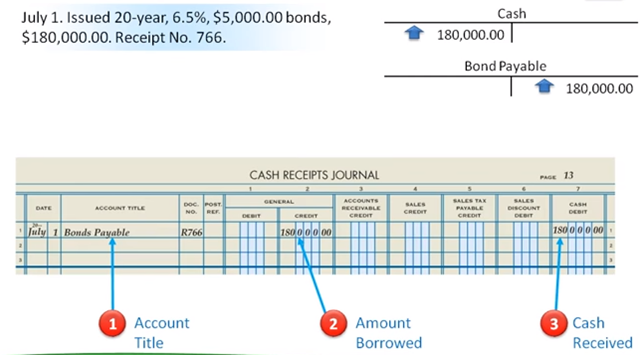

Issuing

Bonds

•Bond:

A long term promise to pay a specified amount on a specified date and to pay

interest at stated intervals.

•All

bonds representing the total amount of a loan are called a bond issue.

- The process of selling bonds is commonly known as issuing bonds.

- The process of selling bonds is commonly known as issuing bonds.

•The

face value is the amount to be repaid at the end of the bond term.

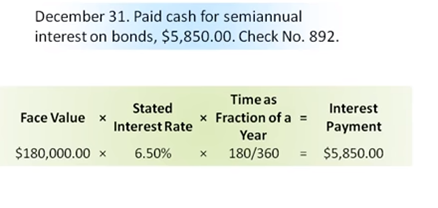

•The

interest rate used to calculate periodic interest payments on a bond is called

the stated interest rate.

Issuing

Bonds

Short

Term Debt Financing Options

•Every

business needs cash to pay its operating expenses. Purchasing inventory and

paying the payroll are examples of daily activities that require a business to

earn revenue.

•The

payment of an operating expense is necessary to earn revenue is called revenue

expenditure.

Última modificación: martes, 14 de agosto de 2018, 08:29