Reading: Liquidity Ratios

How

Do We Use Ratios to Analyze a Business

•Different

ratios explain different aspects of a company.

•Ratios

are used for the following purposes:

- Evaluating the ability to pay current liabilities and long-term debt

- Evaluating the ability sell merchandise inventory and collect receivables.

- Evaluating profitability

- Evaluating stock as an investment

- Evaluating the ability to pay current liabilities and long-term debt

- Evaluating the ability sell merchandise inventory and collect receivables.

- Evaluating profitability

- Evaluating stock as an investment

How

Do We Use Ratios to Analyze a Business

Evaluating

the Ability to Pay Current Liabilities

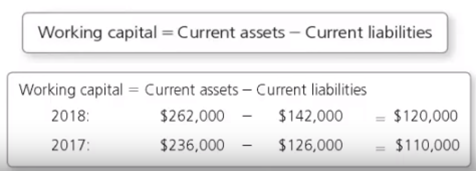

•Working

capital measures the ability to meet short term obligations with current

assets. Working capital is defined as follows:

Current

Ratio

•The

most widely used ratio is the current ratio. This ratio measures a company’s

ability to pay its current liabilities with its current assets.

Cash

Ratio

•The

cash ratio helps determine a company’s ability to meet its short-term

obligations.

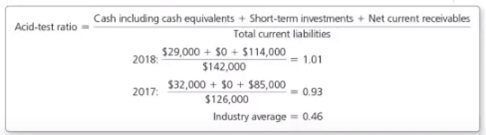

Acid-Test

(or Quick) Ratio

•The

acid-test ratio (sometimes called the quick ratio) tells us whether a company

can pay all its current liabilities if they come due immediately.

Modifié le: mardi 14 août 2018, 08:39