Reading: Time Value of Money

Time

Value of Money

•The

time value of money (TVM) is the idea that money available at the present time

is worth more than the same amount in the future due to its potential earning

capacity. This core principle of finance holds that, provided money can earn

interest, any amount of money is worth more the sooner it is received. TVM is

also referred to as present discounted value.

TVM formula takes into account the following variables:

•FV

= Future value of money

•PV

= Present value of money

•i =

interest rate

•n

= number of compounding periods per year

•t

= number of years

•Based

on these variables, the formula for TVM is:

•FV

= PV x (1 + (i /

n)) ^ (n x t)

What

is Simple Interest?

•Interest

– A rental fee to borrow money

•Simple

interest is when the interest received or paid is based solely on the amount of

money that was initially invested. Therefore, the interest earned each period

or year will be the same.

•Simple

interest formula

Initial investment x (1 + (interest rate x number of periods))

Initial investment x (1 + (interest rate x number of periods))

Compound

Interest

•Compound

interest is much different than simple interest. Compound interest is the kind

of interest you would like to receive in an investment but definitely would not

want to pay. Why? Because the interest rate is based on the balance of the

investment when it is calculated, not the initial investment. What this means

is that interest is being earned on both the investment, and the interest

earned from previous periods.

Compound

Interest

161.05 = $100 x (1+.1) ^5

Future

Value

•Future

value is what a dollar today will be worth in the future. This is because of

the interest that dollar can earn over time, therefore making it more valuable

in the future.

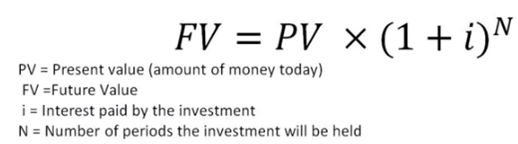

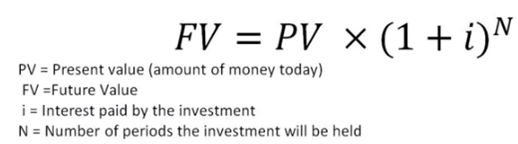

The

Future Value Formula

Future

Value of a $1,000 Corporate Bond

Yield = 10%

Number of Periods = 10

FV = $1,000 x (1 + .1) ^10

FV = $2593.74

Yield = 10%

Number of Periods = 10

FV = $1,000 x (1 + .1) ^10

FV = $2593.74

What

is an Annuity?

•An

annuity is a series of equal payments that are either paid to you of paid from

you. Annuities can be Cash Flow’s paid such as monthly rent payments, car

payments, or they can be money received such as Semi-Annual coupon payments

from a Bond. Just remember, for a series of cash flows to be considered an

annuity, the cash flows need to be equal.

•Annuity

Due: An annuity due is when payment is made at the beginning of the payment

period. Rent for example where you are usually required to pay rent in advance

at the first of the month.

•Ordinary

Annuity: An ordinary annuity is a payment that is paid or received at the end

of the period. An example of an ordinary annuity would be a coupon payment made

from bonds. Usually bonds will make semi-annual coupon payments at the end of

every six months

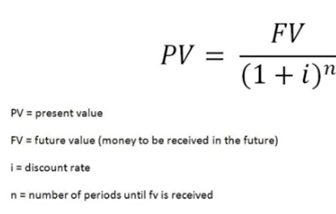

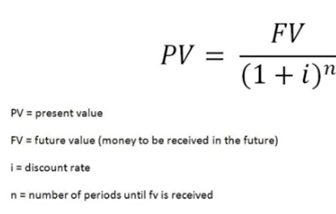

Present

Value

•Present

value (PV) is the current worth of a future sum of money or stream of cash

flows given a specified rate of return. Future cash flows are discounted at the

discount rate, and the higher the discount rate, the lower the present value of

the future cash flows. Determining the appropriate discount rate is the key to

properly valuing future cash flows, whether they be earnings or

obligations.

•PV

is also referred to as the "discounted value." The basis is that

receiving $1,000 now is worth more than $1,000 five years from now, because if

you got the money now, you could invest it and receive an additional return

over the five years.

•

•The

money today is worth more than the same money tomorrow because the passage of

time has financial value attached to it and rewards or costs are demanded for

owning or using today's money. Future value can relate to future investment

cash inflows from investing today's money or future payment outflows from

borrowing today's money.

•Present

value provides a basis for assessing the fairness of any future financial

benefits or liabilities. For example, a future cash rebate discounted to

present value may or may not be worth having a potentially higher purchase

price. The same financial calculation applies to 0% financing when buying a

car. Paying some interest instead on a lower sticker price may work out better

for the buyer than paying zero interest on a higher sticker price. Paying

mortgage points now in exchange for lower mortgage payments later makes sense

only if the present value of the future mortgage savings is greater than the

mortgage points paid today.

Present

Value Formula

Present

Value of a Cash Flow Series

最后修改: 2018年08月14日 星期二 08:41