Reading: Finding the Compound Interest Rate and Number of Time Periods

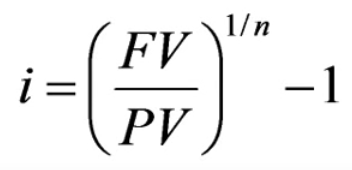

Formula

to Solve for Interest (i)

•The

formula to find the interest rate per compounding period is:

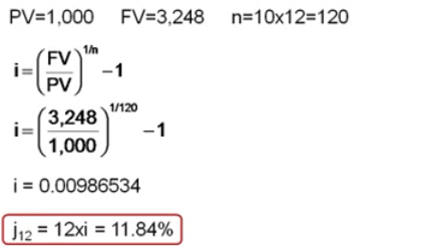

Example:

Finding the Rate

Matthew

purchased $1,000 worth of Megastore shares 10 years ago. He just sold them for

$3,248. What monthly compounded rate of return did he realize on his

investment?

Solving

for Number of Time Periods

Example

•Suppose

you want to buy a new house. You currently have $15,000, and you figure you

need to have a 10% down payment plus an additional 5% of the loan amount for

closing costs. Assume the type of house you want will cost $150,000 and you can

earn 7.5% per year on an investment. How long will it take you to have enough

money for the down payment, and the closing costs?

Number

of Time Periods – Example cont.

•How

much do you need to have in the future?

- Down payment = .1($150,000) = $15,000

- Closing costs = .05($150,000 – $15,000) = $6,750

- Total needed = $15,000 + $6,750 = $21,750

- Down payment = .1($150,000) = $15,000

- Closing costs = .05($150,000 – $15,000) = $6,750

- Total needed = $15,000 + $6,750 = $21,750

•Compute

the number of periods

- PV = -15,000; FV = 21,750; I/Y = 7.5

- NPER(RATE,PMT,-PV,FV)

- NPER(.075,0,-15000,21750)

- NPER = 5.14 years

- PV = -15,000; FV = 21,750; I/Y = 7.5

- NPER(RATE,PMT,-PV,FV)

- NPER(.075,0,-15000,21750)

- NPER = 5.14 years

Last modified: Tuesday, August 14, 2018, 8:41 AM