Reading: Key Features of Bonds

What

is a Bond?

•A

long-term debt instrument in which a borrower agrees to make payments of

principal and interest, on specific dates, to the holder of the bonds.

Bond

Markets

•Primarily

traded in the over-the-counter (OTC) market.

•Most

bonds are owned and traded among large financial institutions.

•The

Wall Street Journal reports key developments in the Treasury, corporate, and

municipal markets.

Key

Features of a Bond

•Par

value: face amount of the bond, which is paid at maturity (assume $1,000).

•Coupon

interest rate: stated interest rate (generally fixed) paid by the issuer.

Multiply by par value to get dollar payment of interest.

•Maturity

date: years until the bond must be repaid.

•Issue

date: when the bond was issued.

•Yield

to maturity: rate of return earned on a bond held until maturity (also called

the “promised yield”).

Effect

of a Call Provision

•Allows

issuer to refund the bond issue if rates decline (helps the issuer, but hurts

the investor).

•Bond

investors require higher yields on callable bonds.

•In

many cases, callable bonds include a deferred call provision and a declining

call premium.

What

is a Sinking Fund?

•Provision

to pay off a loan over its life rather than all at maturity.

•Similar

to amortization on a term loan.

•Reduces

risk to investor, shortens average maturity.

•But

not good for investors if rates decline after issuance.

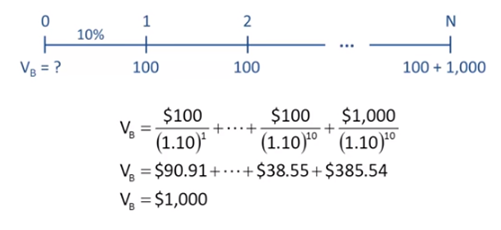

What

is the Value of a 10 year, 10% annual coupon bond, if rd =

10%?

Modifié le: mardi 14 août 2018, 08:42