Reading: Restructuring Through Bankruptcy

Bankruptcy

•Bankruptcy

can be a creative corporate finance tool. Reorganization through the bankruptcy

process can in certain instances provide unique benefits that are unattainable

through other means.

•Clearly,

bankruptcy is a drastic step that is only pursued when other more favorable

options are unavailable. A bankruptcy filing is an admission that a company has

in some way failed to achieve certain goals.

Bankruptcy

Overview

The Bankruptcy Act of 1978 (the Bankruptcy Code) is the main bankruptcy law of the United States. It organizes bankruptcy laws into eight odd-numbered chapters.

Economic

Failure

•Economic

failure is the more ambiguous. For example, economic failure could mean that

the firm is generating losses; that is, revenues are less than costs.

•However

depending on the users and the context, economic failure could also mean that

the rate of return on investment is less than the cost of capital. It could

also mean that the actual returns earned by a firm are less than those that

were forecast.

Financial

Failure

•Financial

failure is less than ambiguous than economic failure. Financial failure means

that a company cannot meet its current obligations as they come due. The

company does not have sufficient liquidity to satisfy its current liabilities.

Causes

of Business Failure

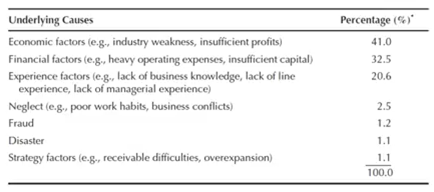

•The

three most common factors of business failure were economic factors, such as

weakness in the industry; financial factors, such as inefficient

capitalization; and weaknesses in managerial experience, such as insufficient

managerial knowledge.

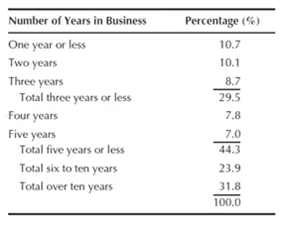

•Research

analysis shows that 10.7% of businesses failed in one year or less. Just under

one-third of the companies were in business for three years or less, where as

44.3% existed up to five years.

Causes

of Financial Distress

•Financial

distress and bankruptcy have been linked to many of the highly leveraged deals

that took place in the 1980’s.

•Studies

have been conducted of a study of 29 leveraged recapitalizations that took

place between 1984 and 1988. They defined leveraged recapitalizations as

transactions that use proceeds from new debt obligations to make payouts to

shareholders. The results show that 31% of the firms that completed leveraged

recapitalizations encountered financial distress.

Chapter

11 Reorganization

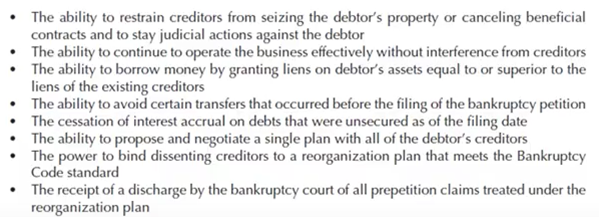

•The

purpose of the reorganization section (Chapter 11) of the Bankruptcy Code is to

allow a reorganization plan to be developed that will allow the company to

continue to operate. This plan will contain the changes in the company that its

designers believe are necessary to convert it to a profitable entity.

•If

a plan to allow the profitable operation of the business cannot be formulated,

the company may have to be liquidated, with its assets sold and the proceeds

used to satisfy the company’s liabilities.

Benefits

of Chapter 11 Process for the Debtor

Chapter

7 - Liquidation

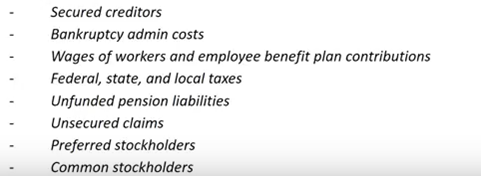

•Liquidation

is a distressed firm’s most drastic alternative, and it is usually pursued only

when voluntary agreement and reorganization cannot be successfully implemented.

In a liquidation, the company’s assets are sold and the proceeds are used to

satisfy claims, priority as follows:

Última modificación: martes, 14 de agosto de 2018, 08:43