Reading: Fama-French Three Factor Model

CAPM

Capital Asset Pricing Model

Portfolio

of Stocks with Similar Betas

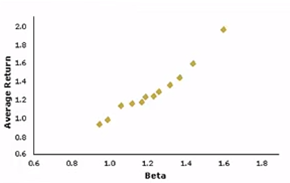

•After

forming portfolios of stocks with similar betas, the subsequent portfolio

returns are observed and shown in the following plot.

CAPM

Linear Function of Beta

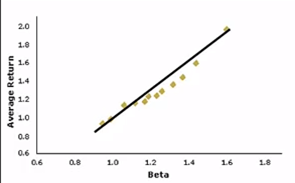

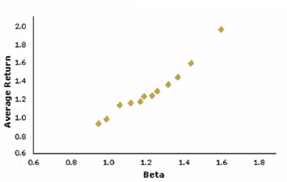

•After

forming portfolios of stocks with similar betas, the subsequent portfolio

returns are observed and shown in the plot.

•CAPM

says expected return is positive, linear functions of beta.

•This

plot of actual data shows a positive, linear relation so the model seems to

work.

•But

CAPM says that beta is the only asset-specific factor that you need to know to

estimate expected return. Other factors should add no value in estimating

expected return.

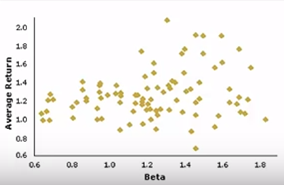

CAPM

Linear Function of Beta

The lower plot adjusts returns for the effects of size and book to market equity.

After these factors are taken into account, there seems to be no relation between expected return and beta.

The positive linear relationship is gone.

Last modified: Tuesday, August 14, 2018, 8:46 AM