Reading: Stock Valuation

Facts

about Common Stocks

•Represents

ownership

•Ownership

implies control

•Stockholders

elect Board of Directors

•Directors

elect management

•Management’s

goal: Maximize stock price

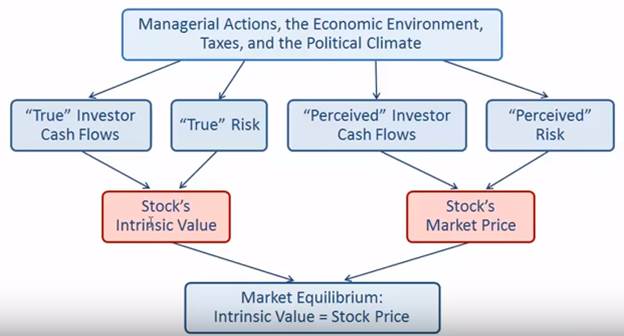

Intrinsic

Value and Stock Price

•Outside

investors, corporate insiders, and analysts use a variety of approaches to

estimate a stock’s intrinsic value (P0).

•In

equilibrium we assume that a stock’s price equals its intrinsic value.

- Outsiders estimate intrinsic value to help determine which stocks are attractive to buy or sell.

-Stocks with a price below (above) intrinsic value are undervalued (undervalued).

- Outsiders estimate intrinsic value to help determine which stocks are attractive to buy or sell.

-Stocks with a price below (above) intrinsic value are undervalued (undervalued).

Determinants

of Intrinsic Value and Stock Prices

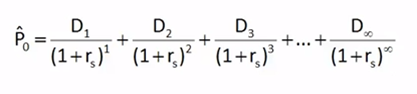

Discounted

Dividend Model

•Value

of a stock is present value of the future dividends expected to be generated by

the stock.

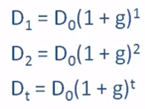

Constant

Growth Stock

A stock whose dividends are expected to grow forever at a constant rate, g.

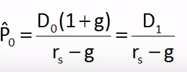

•If

g is constant, the discounted dividend formula converges to:

What

happens if g > rs?

•If

g > rs, the

constant growth formula leads to a negative stock price, which does not make

sense.

•The

constant growth model can only be used if:

- rs > g

- g is expected to be constant forever.

- rs > g

- g is expected to be constant forever.

Use

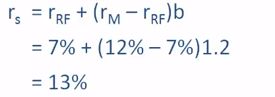

CAPM to Calculate the Required Rate of Return

•If

rRF =

7%, rM =

12%, and b = 1.2, what is the required rate of return on the firm’s stock?

Find

the Expected Dividend Stream for the Next 3 Years and Their PV’s

Last modified: Tuesday, August 14, 2018, 8:49 AM