Reading: Preferred Stock

Preferred

Stock

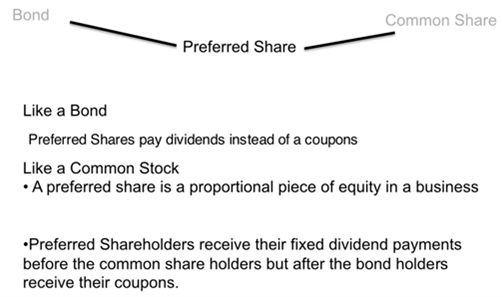

•A

preferred stock is a class of ownership in a corporation that has a higher

claim on its assets and earnings than common stock. Preferred shares generally

have a dividend that must be paid out before dividends to common shareholders,

and the shares usually do not carry voting rights.

•

•Preferred

stock combines features of debt, in that it pays fixed dividends, and equity,

in that it has the potential to appreciate in price. The details of each

preferred stock depend on the issue.

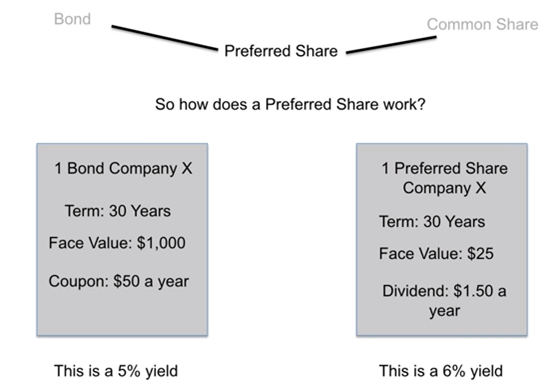

•Preferred

shares have less potential to appreciate in price than common stock, and they

usually trade within a few dollars of their issue price, most commonly $25.

Whether they trade at a discount or premium to the issue price depends on the

company's credit-worthiness and the specifics of the issue: for example,

whether the shares are cumulative, their priority relative to other issues, and

whether they are callable.

Callable

and Convertible Preferred Shares

•If

shares are callable, the issuer can purchase them back at par value after a set

date. If interest rates fall, for example, and the dividend yield does not have

to be as high to be attractive, the company may call its shares and issue

another series with a lower yield. Shares can continue to trade past their call

date if the company does not exercise this option.

•Some

preferred stock is convertible, meaning it can be exchanged for a given number

of common shares under certain circumstances. The board of directors might vote

to convert the stock, the investor might have the option to convert, or the

stock might have a specified date at which it automatically converts. Whether

this is advantageous to the investor depends on the market price of the common

stock.

What

is a Preferred Share

What

is a Preferred Share

Última modificación: martes, 14 de agosto de 2018, 08:49