•Money

used to start or run a business.

•Weighted

average cost of capital (WACC) is a calculation of a firm's cost of capital in

which each category of capital is proportionately weighted.

•All

sources of capital, including common stock, preferred stock, bonds and any

other long-term debt, are included in a WACC calculation. A firm’s WACC

increases as the beta and rate of return on equity increase, as an increase in

WACC denotes a decrease in valuation and an increase in risk.

•Debt

and equity are the two components that constitute a company’s capital funding.

Lenders and equity holders will expect to receive certain returns on the funds

or capital they have provided. Since cost of capital is the return that equity

owners (or shareholders) and debt holders will expect, so WACC indicates the

return that both kinds of stakeholders (equity owners and lenders) can expect

to receive. Put another way, WACC is an investor’s opportunity cost of taking

on the risk of investing money in a company.

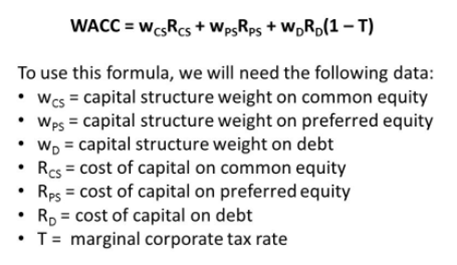

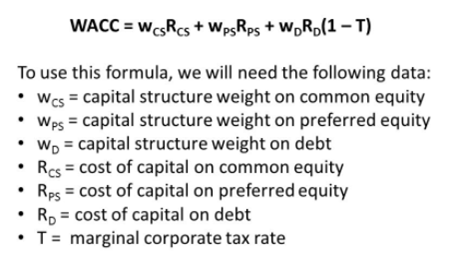

Variables

Needed to Calculate WACC

WACC

Example

Sanstreet, Inc. went public by issuing 1 million

shares of common stock @ $25 per share. The shares are currently trading at $30

per share. Current risk free rate is 4%, market risk premium is 8% and the

company has a beta coefficient of 1.2.

During last year, it issued 50,000 bonds

of $1,000 par paying 10% coupon annually maturing in 20 years. The bonds are

currently trading at $950.

The tax rate is 30%. Calculate the

weighted average cost of capital.

WACC

Example

First we need to calculate the proportion

of equity and debt in Sanstreet,

Inc. capital structure.

Current Market Value of Equity =

1,000,000 × $30 = $30,000,000

Current Market Value of Debt = 50,000 × $950 = $47,500,000

Total Market Value of Debt and Equity = $77,500,000

Weight of Equity = $30,000,000 / $77,500,000 = 38.71%

Weight of Debt = $47,500,000 / $77,500,000 = 61.29%

WACC

Example

•Now,

we need estimates for cost of equity and after-tax cost of debt.

•

•We

can estimate cost of equity using either dividend discount model (DDM) or

capital asset pricing model (CAPM).

•

•Cost

of equity (DDM) = expected dividend in 1 year /current stock price + growth

rate

•Cost

of equity (CAPM) = risk free rate + beta coefficient × market risk premium

•

•In

the current example, the data available allow us to use only CAPM to calculate

cost of equity.

•Cost

of Equity = Risk Free Rate + Beta × Market Risk Premium = 4% + 1.2 × 8% = 13.6%

•

•Cost

of debt is equal to the yield to maturity of the bonds. With the given data, we

can find that yield to maturity is 10.61%.

•

•For

inclusion in WACC, we need after-tax cost of debt, which is 7.427% [= 10.61% ×

(1 − 30%)].

WACC

Example

WACC

= 38.71% × 13.6% + 61.29% × 7.427% = 9.8166%