Reading: Dividend Discount Model

What

is the Dividend Discount Model?

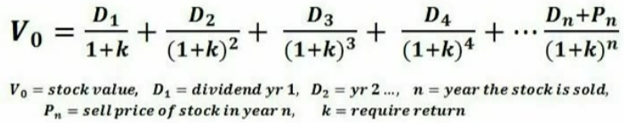

•The

dividend discount model (DDM) is a procedure for valuing the price of a stock

by using the predicted dividends and discounting them back to the present

value. If the value obtained from the DDM is higher than what the shares are

currently trading at, then the stock is undervalued.

DDM

Example

•Company

ABC just paid a $3.00 dividend and its dividend is expected to grow at a rate

of 5% indefinitely. ABC has a beta 1.2, return on the market is 12% and the

risk free rate is 4%. What would the intrinsic value of ABC stock be?

DDM

Example

•First

we would figure out the discount rate (required rate of return) by using the

CAPM.

CAPM

Required return = rf + beta (rm – rf)

.04 + 1.2(.12 - .04) = .136

Constant Growth Dividend Model

$3.00

(1.05) =

$36.63

.136 - .05

Última modificación: martes, 14 de agosto de 2018, 08:50