Reading: Discounted Cash Flow Model

DCF

Model

•Discounted

cash flow (DCF) is a valuation method used to estimate the attractiveness of an

investment opportunity. DCF analyses use future free cash flow projections and

discounts them, using a required annual rate, to arrive at present value

estimates. A present value estimate is then used to evaluate the potential for

investment. If the value arrived at through DCF analysis is higher than the

current cost of the investment, the opportunity may be a good one.

•The

time value of money is the assumption that a dollar today is worth more than a

dollar tomorrow. For example, assuming 5% annual interest, $1.00 in a savings

account will be worth $1.05 in a year. Due to the symmetric property (if a=b,

then b=a), we must consider $1.05 a year from now to be worth $1.00 today. When

it comes to assessing the future value of investments, it is common to use the

weighted average cost of capital (WACC) as the discount rate.

DCF

Model

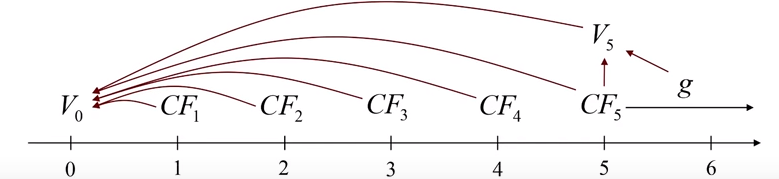

•The

firm’s free cash flow can be used to calculate the value of the firm in a

Discounted Cash Flow model.

•Approach

- Forecast the firm’s future free cash flows

- Discount the cash flows using the firm’s WACC

- Equity value = firm assets minus debt value

- Forecast the firm’s future free cash flows

- Discount the cash flows using the firm’s WACC

- Equity value = firm assets minus debt value

DCF

Model

1.Forecast the near-term cash flows

2.Forecast the long-term growth rate and

terminal value

3.Discount the annual cash flows and

terminal value to determine the present value of the firm

Inputs

to the DCF Model

•Forecast

of future cash flows

- Determine base or initial cash flow

- Forecast near and long term growth rates

- Determine base or initial cash flow

- Forecast near and long term growth rates

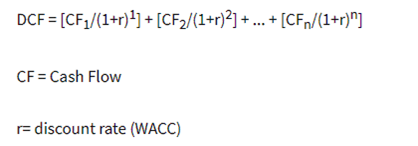

•Discount

rate: WACC

DCF

Example

DCF

Example

•For a

hypothetical Company X, we would apply DCF analysis by first estimating the

firm's future cash flow growth. We would start by determining the company's

trailing twelve month (TTM) free cash flow (FCF), equal to that period's

operating cash flow minus capital expenditures.

•Say

that Company X's current FCF is $50m. We would compare this figure to previous

years' cash flows in order to estimate a rate of growth. It is also important

to consider the source of this growth. Are sales increasing? Are costs

declining? These factors will inform assessments of the growth rate's

sustainability.

DCF

Example

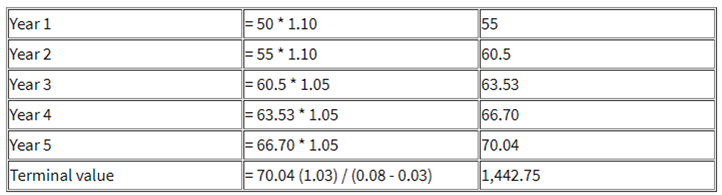

•Say

that you estimate that Company X's cash flow will grow by 10% in the first two

years, then 5% in the following three. After a few years, you may apply a

long-term cash flow growth rate, representing an assumption of annual growth

from that point on. This value should probably not exceed the long-term growth

prospects of the overall economy by too much; we will say that Company X's is

3%. You will then calculate a WACC; say it comes out to 8%.

•The

terminal value, or long-term valuation the company's growth approaches, is

calculated using the Gordon Growth Model: Terminal value = projected cash flow

for final year (1 + long-term growth rate) / (discount rate - long-term growth

rate).

DCF

Example

•Now

you can estimate the cash flow for each period, including the terminal value:

•Finally,

to calculate Company X's discounted cash flow, you add each of these projected

cash flows, adjusting them for present value, using the WACC:

•

•DCF

of Company X = (55 / 1.081) + (60.5 / 1.082) + (63.53 / 1.083) + (66.70 /

1.084) + (70.04 / 1.085) + (1,442.75 / 1.085) = 1231.83

•

•$1.23

billion is our estimate of Company X's present enterprise value. If the company

has net debt, this needs to be subtracted, as equity holders' claims to a

company's assets are subordinate to bondholders'. The result is an estimate of

the company's fair equity value. If we divide that by the number of shares

outstanding—say, 10 million—we have a fair equity value per share of $123.18,

which we can compare with the market price of the stock. If our estimate is

higher than the current stock price, we might consider Company X a good

investment.

Última modificación: martes, 14 de agosto de 2018, 08:50