Reading: Financial Risk and Financial Leverage

Financial

Risk and Financial Leverage

•Financial

risk is the additional risk placed on the common stockholders as a result of

the decision to finance with debt. Conceptually, stockholders face a certain

amount of risk that is inherent in a firm’s operations—this is its

business risk, which is defined as the uncertainty in projections of future

EBIT, NOPAT, and ROIC.

•If a

firm uses debt (financial leverage), then the business risk is concentrated on

the common stockholders. To illustrate, suppose ten people decide to form a

corporation to manufacture flash memory drives. There is a certain amount of

business risk in the operation. If the firm is capitalized only with common

equity and if each person buys 10% of the stock, then each investor shares

equally in the business risk.

•However,

suppose the firm is capitalized with 50% debt and 50% equity, with five of the

investors putting up their money by purchasing debt and the other five putting

up their money by purchasing equity. In this case, the five debtholders are

paid before the five stockholders, so virtually all of the business risk is

borne by the stockholders. Thus, the use of debt, or financial leverage,

concentrates business risk on stockholders.

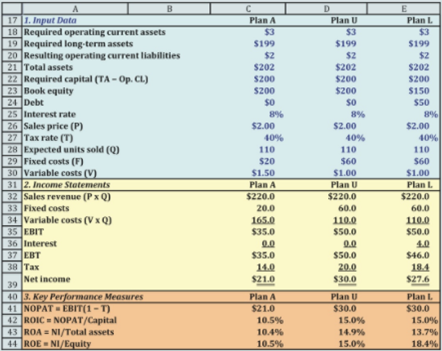

•To

illustrate the impact of financial risk, we can extend the Strasburg

Electronics example. Strasburg initially decided to use the technology of Plan

U, which is unlevered (financed with all equity), but now it’s considering

financing the technology with $150 million of equity and $50 million of debt at

an 8% interest rate, as shown for Plan L (recall that L denotes leverage).

•Compare

Plans U and L. Notice that the ROIC of 15% is the same for the two plans

because the financing choice doesn’t affect operations. Plan L has lower net

income ($27.6 million versus $30 million) because it must pay interest, but it

has a higher ROE (18.4%) because the net income is shared over a smaller equity

base.

•When

the quantity sold is 76 million, both plans have an ROIC of 4.8%. The after-tax

cost of debt also is 8%(1 – 0.40) = 4.8%, which is no coincidence. As ROIC

increases above 4.8%, the ROE increases for each plan, but more for Plan L than

for Plan U.

•However,

if ROIC falls below 4.8%, then the ROE falls further for Plan L than for Plan

U. Thus, financial leverage magnifies the ROE for good or ill, depending on the

ROIC, and so increases the risk of a levered firm relative to an unlevered

firm.

Modifié le: mardi 14 août 2018, 08:55