Reading: Debt Management Ratios

Debt

Management Ratios

Debt Management Ratio is a computation that is a computation that is used to measure a company’s ability to pay its long term debt obligations

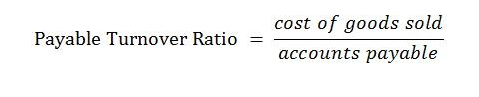

Payables

Turnover

Company A

COGS = $1,000,000

Accounts Payable = $506,000

Payables Turnover = $1,000,000

$506,000

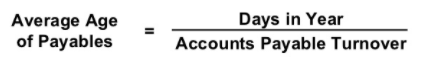

Age

of Payables

Age of Payables = 365

1.97

Age of Payables = 185 days

Debt

to Asset Ratio

Total Assets

Total Assets = $3,373

Current Liabilities = $543

Long Term Debts = $531

Debt to Assets = $543

+ $531

$3,373

Debt to Assets = 31.84%

Debt

to Equity Ratio

Total Equity

Total Equity = $2,299

Current Liabilities = $543

Long Term Debts = $531

Debt to Equity = $543

+ $531

$2,299

Debt to Equity = 46.72%

Times

Interest Earned

Times Interest Earned Ratio = Earnings

before Interest and Taxes

Interest Expense

Interest Expense = $141

TIE = $691

$141

TIE = 4.9 times