Reading: Net Present Value

Net

Present Value

- In case of standalone projects, accept a project only if its NPV is positive, reject it if its NPV is negative and stay indifferent between accepting or rejecting if NPV is zero.

- In case of mutually exclusive projects (i.e. competing projects), accept the project with higher NPV.

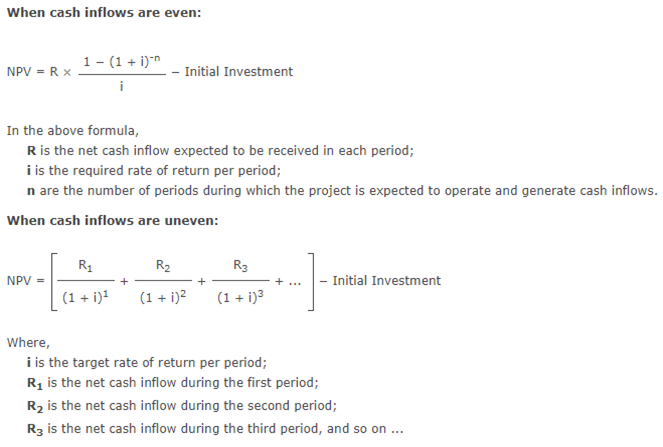

Example 1: Even Cash Inflows: Calculate the net present value of a project which requires an initial investment of $243,000 and it is expected to generate a cash inflow of $50,000 each month for 12 months. Assume that the salvage value of the project is zero. The target rate of return is 12% per annum.

Solution

We have,

Initial Investment = $243,000

Net Cash Inflow per Period = $50,000

Number of Periods = 12

Discount Rate per Period = 12% ÷ 12 = 1%

Net Present Value

= $50,000 × (1 − (1 + 1%)^-12) ÷ 1% − $243,000

= $50,000 × (1 − 1.01^-12) ÷ 0.01 − $243,000

≈ $50,000 × (1 − 0.887449) ÷ 0.01 − $243,000

≈ $50,000 × 0.112551 ÷ 0.01 − $243,000

≈ $50,000 × 11.2551 − $243,000

≈ $562,754 − $243,000

≈ $319,754

Net

Present Value Example

Example 2: Uneven Cash Inflows: An initial investment of $8,320 thousand on plant and machinery is expected to generate cash inflows of $3,411 thousand, $4,070 thousand, $5,824 thousand and $2,065 thousand at the end of first, second, third and fourth year respectively. At the end of the fourth year, the machinery will be sold for $900 thousand. Calculate the net present value of the investment if the discount rate is 18%. Round your answer to nearest thousand dollars.

Solution

PV Factors:

Year 1 = 1 ÷ (1 + 18%)^1 ≈ 0.8475

Year 2 = 1 ÷ (1 + 18%)^2 ≈ 0.7182

Year 3 = 1 ÷ (1 + 18%)^3 ≈ 0.6086

Year 4 = 1 ÷ (1 + 18%)^4 ≈ 0.5158

Net

Present Value Example

Strengths

and Weaknesses of NPV

-Net present value accounts for time value of money which makes it a sounder approach than other investment appraisal techniques which do not discount future cash flows such payback period and accounting rate of return.

-Net present value is even better than some other discounted cash flows techniques such as IRR. In situations where IRR and NPV give conflicting decisions, NPV decision should be preferred.

- NPV is after all an estimation. It is sensitive to changes in estimates for future cash flows, salvage value and the cost of capital.

-Net present value does not take into account the size of the project. For example, say Project A requires initial investment of $4 million to generate NPV of $1 million while a competing Project B requires $2 million investment to generate an NPV of $0.8 million. If we base our decision on NPV alone, we will prefer Project A because it has higher NPV, but Project B has generated more shareholders’ wealth per dollar of initial investment ($0.8 million/$2 million vs $1 million/$4 million).